In case you missed the news in August while you were on summer holiday, Sabre (NASDAQ: SABR) announced analyst expectations for both revenue and non-GAAP earnings. Management cited weakness in air distribution bookings as a key factor. CEO Kurt Ekert described the performance as “below expectations,” attributing the shortfall to a combination of industry-wide GDS weaknesses and Sabre’s higher exposure to underperforming markets. Ekert noted, “The operating environment remains challenging and is pressuring air distribution bookings.”

How We Got Here

In the global travel ecosystem, the Global Distribution System (GDS) is more than a piece of infrastructure—it’s the connective tissue that binds together airlines, hotels, travel agencies, corporate booking tools, and a long tail of niche service providers. Without it, the relatively efficient, transparent marketplace we take for granted would look very different—and not necessarily for the better.

The GDS model serves a unique purpose: it is intended to be a neutral marketplace where prices can be efficiently compared and where connectivity reaches every corner of the distribution chain. That means the same fare or room rate is accessible to a multinational travel management company and to a small, independent agency serving a local community. No other system to date attempts to offer that level of breadth and balance.

Yes, technology is evolving rapidly. New retailing platforms, supplier direct-connect APIs, dynamic pricing, and AI-powered search tools are emerging that can deliver content faster and, in some cases, cheaper. But they are not comprehensive marketplaces. They excel at point-to-point connections and tailored experiences, yet they lack the universal reach and competitive transparency that come from aggregating vast amounts of content across thousands of suppliers and intermediaries. For the foreseeable future, the travel ecosystem needs both: nimble innovation and a robust marketplace backbone.

It’s fair to say the pace of GDS innovation has frustrated many. The industry would have preferred faster moves toward modern retailing, better merchandising, and richer data. But when you serve a truly global marketplace – with many thousands of stakeholders with a broad range of sophistication and limited access to capital – speed is not just about the ideas. It’s about implementing them at scale without breaking the network that underpins billions in transactions. That requires time, massive amounts of capital, and, above all, stability.

All the “dinosaur” references about the GDS players that have been around for years are cynical, but hardly accurate. It is just a very convenient way of criticizing the technology platforms that has acted not only as a critical travel industry backbone, but very effectively served as a collective bargaining forum for travel agencies on behalf of their customers. In short, what would the cost of travel for customers be today without the GDS?

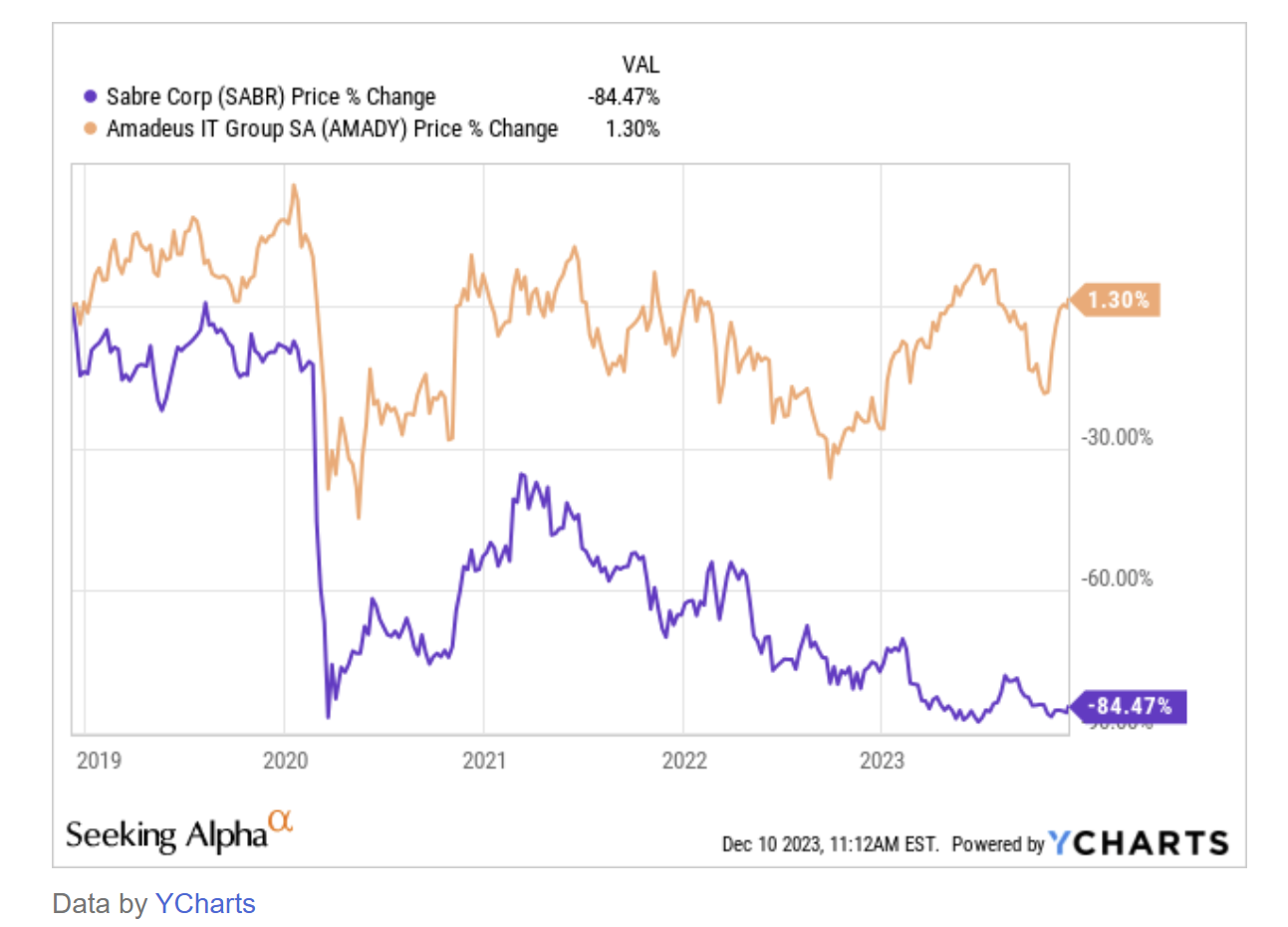

But in Sabre’s case, they are still paying the price for strategic missteps by Sabre’s previous, pre-COVID leadership that were further exposed as a result of the pandemic’s impact on the entire travel industry. This is evidenced by the distinctively different trajectories of Sabre and the GDS market leader, Amadeus (OTCMKTS: AMADY) over recent history.

Where We Go From Here

Now, with Sabre under significant short-term earnings pressure, carrying a crushing debt load, and victims of a recent punishing sell-off of its stock – the market again faces a real possibility: consolidation that reduces three global players to two or one. The third GDS player, Travelport, was taken private in 2019. As a private company, Travelport’s financial information is not disclosed publicly, however, their S&P credit rating is available. That rating has reportedly dropped from a “B” (March 2020) to a “CCC+/D” (late-2024) with Travelport’s total estimated debt load similar in size to Sabre.

History tells us that when a marketplace becomes dominated by a single or near-single provider, innovation slows, pricing power concentrates, and smaller participants get squeezed. Other scenarios are possible—an aggressive restructuring of the GDS-commercial model which is an important part of the travel agency financial model, or unintended consequences we haven’t even imagined. The path ahead is uncertain.

What is certain is that more travel marketplace change is coming, and in a big way. As it does, we should be asking ourselves what kind of distribution ecosystem we want to preserve and build upon. A competitive, transparent, and accessible marketplace is in the best everyone’s interest—travelers, agencies, technology innovators, and yes, suppliers alike.

Sabre’s customers, debt holders, and industry leaders will ultimately need to decide how they want to react. Do they join in the “sell-off” of Sabre? Or do they lean into the belief that this Sabre or some future version can be competitive in the years to come?

Sabre’s survival in some form isn’t about protecting the past. It’s about protecting the principle that in travel, as in any market, competition is healthy, choice is essential, and the best innovations come when no single player controls the field.

For more insight into how this analysis effects your future business strategy, contact me at mike.mccormick@travelagainadvisory.com.

For media inquiries, please email media@travelagainadvisory.com.

Michael W. McCormick is Co-Founder and Managing Partner of Travel Again Advisory, a strategic M&A consultancy advising travel and technology brands. He previously served as Executive Director of the Global Business Travel Association (GBTA), and held various travel industry senior leadership roles including at Cendant, where he led the Hospitality & Leisure Group with brands such as Travelport, Orbitz, Cheap Tickets, and Lodging.com. Mike is a recognized travel expert, frequent industry commentator, and brand spokesperson.